Personal data breach: $13.5 billion in fines imposed in 2021

An individual's name, phone number, email, home address, among others, are part of the long list of what is considered personal data in Colombia . In the country there is a regulation that limits the treatment of them, and people have the right to authorize or not their use, especially when it comes to commercial purposes.

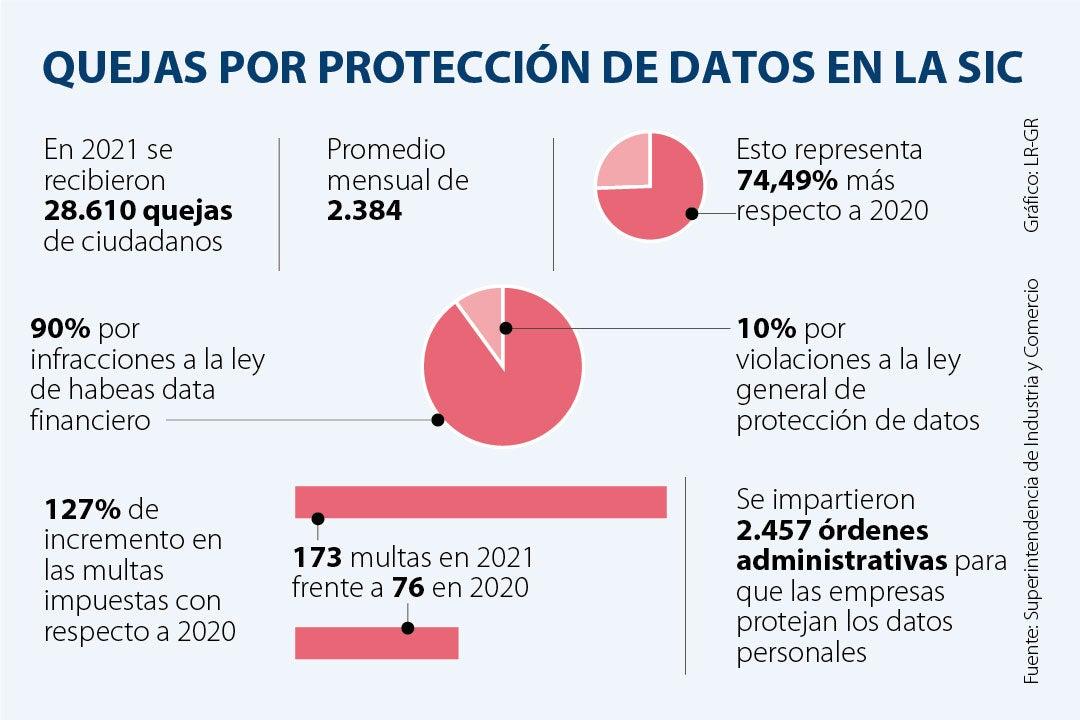

The Superintendence of Industry and Commerce is the entity in charge of ensuring the proper processing of personal data, and this is how it recently reported that in 2021 it received 28,610 complaints from people who consider that their rights in this matter are being violated. This figure translates into an increase of 74.49% compared to 2020.

It may interest you: Should the Registrar control the monopoly of biometric data?

“90% of the complaints were filed for alleged violations of Statutory Law 1266 of 2008 (financial habeas data), where the main complaint was the “Breach of the principle of truthfulness or quality of information” (the data is not true or are outdated); the remaining 10% of the complaints are for violations of Statutory Law 1581 of 2012 (General Data Protection Law), where the main complaint was the "Lack of authorization to collect and use data," explained the superintendence.

Also read: Facial recognition: will we all be suspects in the future?

Within the framework of World Data Protection Day , it was also known that an increase of 127% (compared to 2020) in the fines imposed was achieved last year. The entity specified that the value of the 173 fines exceeded $13,500 million

A higher number was also reached in administrative orders for companies to comply with what the law on the protection of personal data indicates. There were 2,457 orders issued.

Also read: They seek to summarize terms and conditions of use of apps so that users read them

The superintendence also celebrated the fact that last year it launched two guides that provide information to citizens on the protection of their personal data:

“The main reasons why Colombians went to the “SIC Facilita” platform were: i) identity theft, ii) lack of prior communication to the client before the negative report and, iii) erroneous reporting of obligations that are not in arrears. ”, concluded the SIC.