Uncle's digital version story: how do they now access your data and take out all your money?

Deception doesn't go out of style: it's going digital. Before, a person could be approached on the street and scammed with some scheme, but now they are contacted through online channels.

In the old fashioned way, criminals use different arguments to defraud unsuspecting users and consumers and, in most cases, keep all their money.

The pandemic allowed this trend to accelerate even more because people spend more time on the Internet and has allowed the sophistication of the gadgets of these organized gangs that, contrary to what one might imagine, are practically analog.

"These are people with experience in scams who are connected all day looking for opportunities, but they hardly use technology," Cristian Borghello, director of the Observatory of Computer Crimes in Latin America (ODILA), confides to iProUP.

The expert adds that this action is known as social engineering, a modality that allows obtaining confidential information from a person through manipulation.

No one is exempt from being a victim of a hoax because we are all vulnerable to the psychological action of cybercriminals, who collect all kinds of data to build personalized hoaxes according to the age and characteristics of people.

Opportunity makes perfect a thief

Cybercriminals commonly use phishing, which involves impersonating a bank or other company and communicating with the victim through forged messages via email, social media, and WhatsApp.

They can also do so through SMS text messages, a modality known as smishing; or phone calls, called vishing. The goal is always to get hold of personal data.

According to data from the Argentine Association for the Fight Against Cybercrime (AALCC), scams according to the medium are divided as follows:

"Cybercriminals often contact older adults by phone with the excuse of some bonus or benefit linked to their retirement or pension. To collect it, scammers ask them to follow a series of instructions and, in this procedure, they obtain sensitive information , such as certain personal and bank details, address or email passwords", reveals Borghello.

Younger people, familiar with social networks and technology, are usually contacted in this way under the pretext of having won a raffle, for example.

Another common deception is to make a person believe that they had a virtual sexual encounter and that the other individual involved is not of legal age. In this case, money is requested under the threat of filing a complaint for child abuse.

The advance of e-commerce and the proliferation of alternative marketplaces, such as sales through Facebook or Instagram, are a common scenario for all kinds of deception such as:

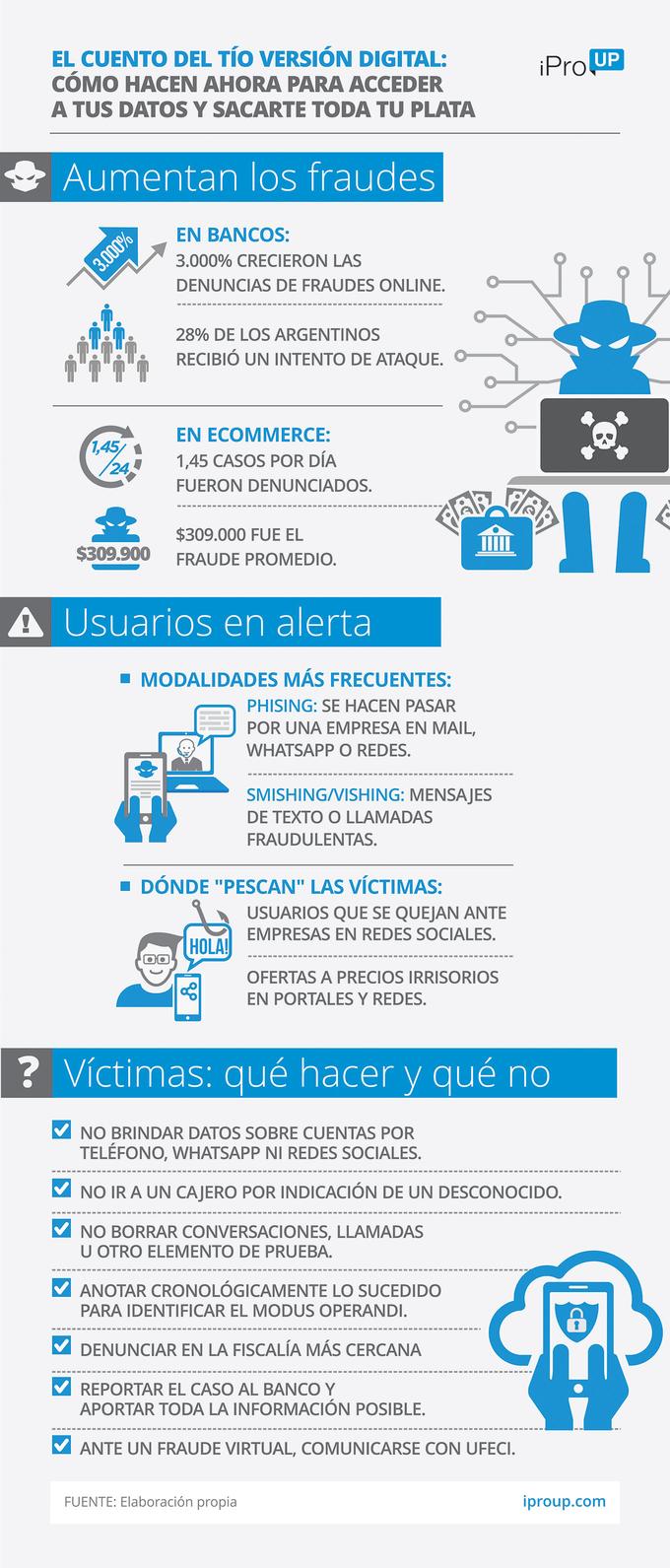

The truth is that the figures are growing at frightening levels. According to ODILA data, with information provided by users and consumers, in the first half of 2021 the following were reported:

Complaints of bank fraud grew by 3,000% in Argentina during 2020 and 28% of the population received a bank fraud attempt via email.

The pandemic brought new forms of deception built with elements of this new context. On many occasions, these gangs make random calls and build scams with arguments about the vaccine or the collection of some social assistance such as the IFE.

Other cases arise when users, unable to file a complaint over the phone or attend a bank branch, service company or airline, report their problems on social networks and are later contacted by scammers privately to "solve the problem.

Horacio Azzolin, head of the Specialized Cybercrime Fiscal Unit (UFECI), reveals to iProUP that "the vast majority of reported cases are related to online purchases through Instagram, OLX or the marketplace accounts Facebook".

"Uncle's story is more closely linked to bank fraud that grew 3,000% and in which all actions have a common denominator: people who pretend to be your bank and in the process of solving a problem ask you for the your account credentials and they empty it for you", he completes.

Identity theft on WhatsApp deserves a separate chapter. This form of deception consists of cloning a person's account to write messages to their contacts and urgently ask them for money, or copy a user's profile and replicate it to another number for the same purpose.

Are banking or e-commerce platforms safe?

The available technology and security barriers to prevent cyberattacks and detect fraud are growing and becoming more complex, as are cybercriminal gangs. Control agencies require security and data protection measures from both financial institutions and electronic commerce platforms.

At the beginning of July, the Central Bank ordered financial institutions to reliably verify the identity of people who request pre-approved loans through electronic channels.

For this, they must control the contact points indicated by the user and only then, and only if there are no objections, credit the amount in the account within the following 48 business hours.

Regarding e-commerce platforms, Borghello clarifies that e-commerce itself does not pose any danger, since they are usually safe sites that continually add new fraud detection methodologies. However, he warns: the more media, the greater the chances that a person will be deceived.

In the same vein, Azzolin reveals that "most fraud occurs because the person, deceived, provided their information. If that same person is approached on the street by someone who tells them they are from their bank, they will not I would give you the keys to your house.

"There is a lack of education and a carelessness in the way of managing digitally. It has been studied worldwide that when people enter the Internet they relax their alerts", he indicates.

And he adds: "On the one hand, there is a lack of information about the risks to which users are exposed in digital environments. On the other, banks do not implement enough measures to establish fraud patterns for fear of slowing down trade ".

How to be protected

Recommendations to protect yourself against possible deception abound, but they are not enough. Specialists agree that an active role on the part of banks and other organizations is necessary to raise awareness.

From ODILA they warn that people should take into account that financial institutions never request personal data through any means of communication and recommend:

Santiago Pontiroli, security analyst at Kaspersky, tells iProUP that it is essential to "download applications only from official Android stores, not use the same password for various websites or services or click on suspicious links, and lend special attention to the permissions that the apps request, taking into account that they should not ask for access to the SMS".

To these recommendations can be added some software solutions to protect devices. In this sense, the analyst suggests that, in order to receive notifications about a malicious link or file, behavior-based solutions such as Kaspersky Total Security can be incorporated.

Other tools they recommend are a password manager, which avoids having to remember them; and cloud-based security suites to block sophisticated malware infection attempts.

You have to be careful with complaints on social networks: criminals can be contacted by posing as the companyFor his part, Pablo Pirosanto, SP Security Architect of Logicalis Hispanic America, tells iProUP that Cisco Secure Email includes advanced protection capabilities to detect, block, and remediate phishing faster, prevent data loss, and protect sensitive information in transit with end-to-end encryption.

It may interest youEarning dollars with Axie Infinity is easier: with this platform you fund with pesos and withdraw blue prizes

The increasing exposure to digital environments, greatly amplified by the pandemic, leaves people more exposed to the possibility of being deceived. That is why it is necessary to be even more vigilant, incorporate cybersecurity solutions to be protected and not lower our guard to avoid being fooled by the classic uncle's tale, now in a digital version.

relacionadosestafa fraudetecnologiadiseñocreatividad