The surprising Stockfink story told by its promoters

To do this, we make sophisticated predictive and uncertainty analysis methods available to everyone to quantify risks in decision-making. Although these methods could be used to build a proprietary fund, this is not our philosophy, and we intend to be disruptive on that level. Thus, our users are able to make and reinforce their decisions through an objective, informed, systematic, aseptic, impartial methodology, and without particular interests. When our clients win, we win too! We also emphasize stock market education (https://stockfink.com/academy/) and artificial intelligence (https://stockfink.com/ai-academy/). With the School of Investors we try to increase the presence of women in the world of trading. It's going to be a very innovative project that you will undoubtedly hear about.

At StockFink we have created an algorithm based on artificial intelligence techniques that allows us to detect when the price of a share is high, when it is low, and what is its most probable variation range during the following week. Our objective is to democratize investment in the stock market through Artificial Intelligence. Every day our algorithm generates a forecast report for each component of the IBEX35, IBEXC, IBEXS, NASDAQ-100 and EURO STOXX-50. According to StockFink:

In more than 15,000 predictions (notarized before a notary)

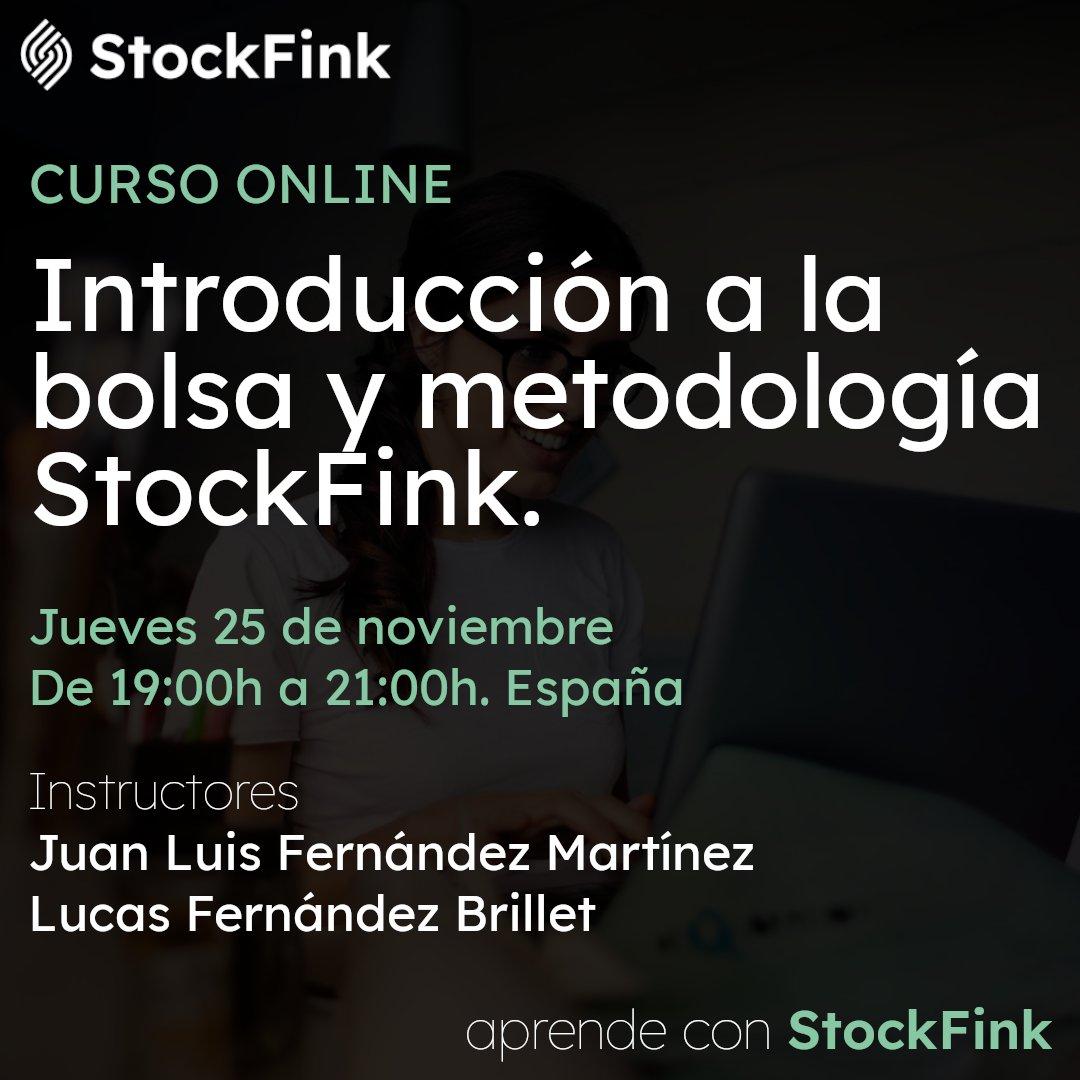

Another relevant aspect is combining a simple methodology with two-hour initiation training courses to the world of trading with StockFink for a price of 40 euros.

Finally, our high-frequency trading algorithms, which we will use in the B2B market to advise funds and fund managers on predictive methods.

Our Competitive Advantage

The use of highly sophisticated artificial intelligence techniques put at the fingertips of our clients in a simple thermometer with five zones: strong buy-buy-hold-sell-strong sell. These techniques include deep neural networks, time series forecasting, uncertainty analysis, reinforcement learning, natural language processing, and sentiment analysis. In a field full of secrecy, we offer you a tool at the level of the state of the art of the "quant" world at a price without competition.

Our business model focused on small investors has the following characteristics:

In-depth analysis

Our AI analyzes thousands of historical data across multiple years and different markets to find and exploit recurring patterns.

Emotion control

Our clients leave emotions aside when trading and establish objective entry and exit limits and risk limits (sell and repurchase stops).

Save time

The AI works by making the analysis easier and allows optimizing decisions without having to be aware of the computer.

We are 100% objective

We convey simply and clearly what the data says. StockFink analyzes the past values of the different shares of the Ibex35 and other markets and makes an estimate of their future value, which is called value percentiles. The 50th percentile, for example, is the value of the stock under which 50% of the predictions are found. Based on these percentiles, we quantify the uncertainty of the value of a share for the next day. This is presented in a very simple thermometer with five prediction zones: there is a strong buy zone, a buy zone, a maintenance zone, a sell zone, and a strong sell zone. Although the strategies are specific to each user, we recommend buying cheap and selling at a reasonable price. Our algorithms are updated every day at the close of the market, which takes into account the latest price changes to make predictions.

We predict the future of financial assets

The stock market prediction problem can be done with its associated uncertainty. It is not a question of predicting the future value of a share that has a degree of uncertainty inherent to the daily march of the market and financial news, but rather of predicting the possible expectations that the value of the share has based on its historical price. Once this prediction is made, it is possible to objectively establish those actions that are "cheap" and those that are "expensive" with respect to their historical prices. It must be remembered that, in the stock market, past benefits do not imply future benefits.

How do subscriptions work?

Once the Spanish trading floor closes (around 5:30 p.m.) our platform downloads the new market data, makes the predictions and generates the pdf documents that you will receive by email every day (around 7:00 p.m.) with the predictions for the next day. This mechanism works as long as the subscription is active. The subscription starts the day after the payment is made. However, that same day we will try to send you the best opportunities of the day so that you can acclimatize.

@kittynoise ooh no i have been pressing "remind me tomorrow" on the mac OS update for about 9 months now. i have ab… https://t.co/yZVyWUWG87

— alex 🦥 Tue Feb 02 17:26:48 +0000 2021

Our clients receive a pdf with the predictions of all the actions and the best opportunities. The range of variability of each action in the next 5 days is predicted, through a simple thermometer that contains five zones: Strong buy-Buy-Hold-Sell-Strong Sell.

In back-tests (paper trading) our algorithms show high profitability. Our methodology is simple and can be used without much prior stock market knowledge. However, the final profitability depends on the user, since we are not a financial advisory company, and we do not know what our users invest in.

We seek to expand internationally: main European, USA, and Asian markets, with special emphasis on India and China.

We will also promote the School of Investors, which tries to increase the presence of Women in the world of trading.

Brief Bio of the Founders

Lucas Fernández Brillet (CEO-CTO)

At the age of 25, he obtained a PhD in Mathematics and Computer Science from Grenoble Alpes University through an industrial doctoral program (CIFRE) in collaboration between STMicroelectronics and Grenoble INP on the design and implementation of Deep Learning systems for detection and recognition of objects in embedded systems. His experience in a highly technological and innovative ecosystem at an international level, such as Grenoble, has led him to the world of Start-ups, and has allowed him to promote a series of potentially revolutionary projects, including StockFink. Previously, he obtained a Master's Degree in Telecommunications from Bordeaux INP with a specialty in digital image and signal processing. StockFink was born from an internship carried out in 2015 by himself together with Juan Luis Fernández Martínez. He is the author of a commercial patent (trade secret) and has published in prestigious international conferences and magazines on artificial intelligence and image processing.

Juan Luis Fernandez Martinez (CSO)

Juan Luis Fernández-Martínez received his PhD in Mining Engineering from the University of Oviedo (Spain, 1994). He previously trained as a petroleum engineer in France (Ècole Nationale du Pètrole et des Moteurs, Paris, 1988) and England (Imperial College, Royal School of Mines, London, 1989). After years of working as a computer software engineer in France, he joined the Department of Mathematics at the University of Oviedo in 1994 and where he has held the position of university professor in Applied Mathematics since 2018. He has also been a professor at the French CNU since 2013. During 2008-2010 he was a research professor at the UC Berkeley-Lawrence Berkeley Lab and at Stanford University. His areas of expertise include inverse problems, uncertainty analysis of complex systems, feature selection and dimension reduction techniques, cooperative global optimization methods, with diverse applications in fields as varied as energy, exploration oil, biometrics, biomedicine and finance. In the field of biomedicine, he is interested in simplifying the complexity of the genome for medical diagnosis and de novo drug design, as well as its repositioning in diseases that have no cure (www.deepbioinsights.com). In the world of AI, he is interested in the design of expert decision support systems (expert robots). In the world of finance, he has been the promoter and co-founder of the Start-up StockFink, where he is also scientific director. He has published more than 220 articles in international journals and has directed and co-directed more than a dozen doctoral theses and numerous final degree and master's degree projects on these topics, nationally and internationally. He holds several US patents on uncertainty analysis in complex and highly dimensional systems.

· For more information :::>>>

https://www.fundssociety.com/es/news/business/stockfink-a-spanish-startup-that-brings-artificial-intelligence-to-the-stock-market-is born

https://cadenaser.com/emisora/2021/05/23/ser_gijon/1621764514_002986.html

https://www.elcorreo.com/economia/tu-economia/la-bolsa-ibex35-stockfink-startup-analiza-modelo-prediccion-covid-20210626125052-nt.html

https://www.elcomercio.es/aviles/bolsa-empresas-financial-20210611002224-ntvo.html#vca=fixed-btn&vso=rrss&vmc=wh&vli=Avilés