Wizink card: Is it worth hiring it?- Analysis and opinions

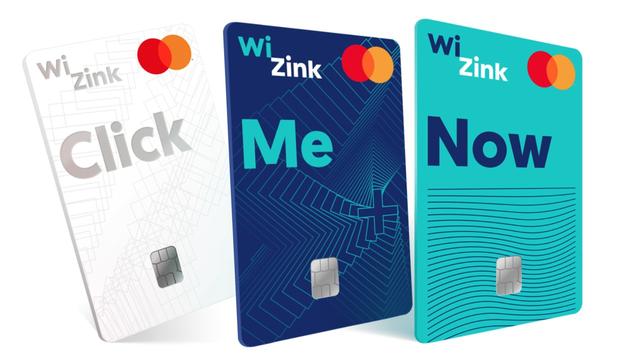

The three new wizink card modalities

TOP 1Crédito WiZink Click Wizink Card18% INTERÉS POR PAGO APLAZADOIR A LA OFERTA ¡Solicítala ahora y llévate 60€ en cheque Amazon!Cuota anual:Gratis ALTAGratis RENOVACIÓN TOP 2Crédito WiZink Tarjeta Wizink Me18% INTERÉS POR PAGO APLAZADOIR A LA OFERTA ¡Solicítala ahora y llévate 60€ en cheque Amazon!Cuota anual:Gratis ALTAGratis RENOVACIÓN TOP 3Crédito WiZink Wizink Now card18% INTERÉS POR PAGO APLAZADOIR A LA OFERTA ¡Solicítala ahora y llévate 60€ en cheque Amazon!Cuota anual:Gratis ALTAGratis RENOVACIÓNSource: Kelisto.It is with Wizink website data

En este artículo podrás informarte acerca de:

- Modalities of the new wizink card

- Is it worth hiring the Wizink card?

- What happens when stopping paying the Wizink card?

- Wizink card: your customers' opinions

- How to request the wizink card

- How to activate the wizink card

- How to unsubscribe the wizink card

- Wizink card: telephone and other forms of contact

- Wizink Revolving Cards: How is the situation in court?

- What happened to the Wizink Plus card and the Wizink gold card?

- Cepsa Wizink Card: What is it for?

At the beginning of the summer, Wizink presented its new range of credit cards, composed of five plastics with very different characteristics: the Wizink Top card (designed for the ancient customers of the entity), the Wizink Wow card (which will be released in 2022), And the Wizink Now, Wizink Me and Wizink click card.On the occasion of this launch, in Kelisto we wanted to analyze how these cards work, what hides their small print and if they really deserve.Of course, we have only examined the now, me and click modalities of the Wizink card, since they are the only ones available for new customers at the close of this article.

Remember that if you want to know the rest of the market offers, you have at your disposal our ranking of the best credit cards, and our credit card comparator, where you can consult the conditions of all plastics available today.

Modalities of the new wizink card

All modalities of the new Wizink credit card have some common characteristics:

Click Wizink Card

Click Wizink CardCréditoIr a la oferta Ver detallesBeyond the features you share with the rest of Wizink credit cards, the Wizink Click card stands out for being the only one that allows the holder to pay purchases between 85 and 1.000 euros in three months without interest or commissions (that is, with a tin of 0% and an equivalent annual rate or rate that will also be 0%).

This makes this Wizink credit card a good option to postpone specific payments, such as the purchase of a television or computer, which can be difficult to assume suddenly for many families.

Wizink me card

Tarjeta Wizink MeCréditoIr a la oferta Ver detallesThe great advantage of the Wizink card is that it offers 3% return in purchases in selected stores, such as Adolfo Domínguez, Air Europa, Carrefour, Iberia or Ryanair, which allows it to sneak into our ranks of the best credit cardsonline and the best credit cards without changing bank.

Now, when hiring it, you must take into account several things:

Wizink Now card

Wizink Now cardCréditoIr a la oferta Ver detalles

The third plastic of the new Wizink credit card range, the Wizink Now card, is the only one that allows holders to access financing through a credit line called NOW credit.This credit will have a maximum limit of 2.000 euros and purchases that are financed with it will be subject to an interest of 7.5% TIN, a much cheaper figure than 18.36% tin than this Wizink plastic charges for postponed purchases in any of its modalities.When requesting it, the money will enter the account in which the card is domiciled, and can be returned up to 24 months.

New Wizink credit card: What are your different modalities differently?

Sources: Kelisto with Wizink website to 08/23/2021

To better understand the differences between the three new Wizink credit cards, in the previous table we summarize its similarities and differences.

Is it worth hiring the Wizink card?

Beyond discounts and special payment methods offered in its different modalities, one of the most important aspects of the Wizink card is the interest it charges for postponed purchases: 18.36% Tin.This is what will really determine if using this means of payment is expensive or cheap and, above all, if there are better cards in the market.

To offer you an answer, in Kelisto we have compared the conditions of the Wizink credit card with those of the rest of plastics that you can find in the market.Our first conclusion is that the interest it charges is high if compared to credit cards with bank linking: that is, those that you can only get if you domicile your payroll in an entity.At present, the best cards of this type apply a TIN that goes from 5.86% to 15.24%.Of course, to enjoy this offer you will not have the flexibility that Wizink offers you, but you must meet several requirements (for example, house payroll and receipts, make card purchases or hire other banking products).

If you are not willing to tie a bank in this way, the interest of any card will be higher, as is logical.At the close of this article, the 10 most interesting credit cards charged between 14.95% and 18.36% TIN (which coincides with the Wizink cards).With these data, you will already mean that Wizink's credit card is part of our monthly ranking of the best credit cards without linking, so if you are looking for such a plastic, opting for it is worth it.

What happens when stopping paying the Wizink card?

If, for your personal circumstances, you must stop paying the Wizink card, you will be breaking the contract you signed with the entity.This can lead to some negative consequences:

Therefore, if you are in a bad financial situation, before paying the Wizink card we recommend that you explore other options, such as negotiating with the entity (especially if you only go back in payment, but you can assume it next month)or choose to gather your debts.

Wizink card: your customers' opinions

To have a clearer idea of this product, then we show you the opinions about the Wizink credit card that some users share through their social networks and other digital platforms:

How to request the wizink card

If you wonder how to request the Wizink card, you must know that the process should be carried out by digital channels.The steps to follow are very easy:

How to activate the wizink card

To activate the Wizink card, you will have to wait to receive it at your home (or in the address you indicate during the application process).Then, you will only need to access your bank application or the customer area of the entity's website and selections the “activate card” option.

During the process to activate the Wizink card, you will be asked to accept the conditions (which should have been sent during the application process) and that you choose and confirm your PIN code.

How to unsubscribe the wizink card

If you want to cancel the Wizink card, you can do it through two ways:

Remember that in order to cancel this card without costs or penalties you will have to have amortized all the debts you had pending for postponed payment.Being a free plastic, you will not have to worry about issues such as the issuance and maintenance commission.

Wizink card: telephone and other forms of contact

Faced with any problem in your daily operation with the Wizink card, the contact phone that the entity makes available to its customers is 91 787 47 47.Its telephone service is from Monday to Friday from 08:00 to 9:00 p.m., and on Saturdays from 08:00 to 3:00 p.m..

The entity also has offices in Madrid, specifically on Ulises street, 16-18.However, in principle they do not attend consultations in person in them.

Wizink Revolving Cards: How is the situation in court?

Wizink cards have attracted a lot.Although, if you want a complete image of the situation, we recommend that you read our detailed analysis of revolving Lastarries, then we briefly summarize how the situation is in court.

In summary, the Revolving cards allow their users to decide how much they want to pay each month of their debt (either a percentage of the same or a fixed amount in euros) and, depending on that, the months that will take to return it will be calculated.In addition, the credit offered by these cards is updated every month, that is, on the one hand, the debt decreases with the fees that are paid, but on the other, it increases as interests, commissions and new purchases are added.

In March 2020, the Supreme Court declared void the contract that a user had with Wizink.The reason?Its Revolving card charged 26.82% Tae, which rose to 27.24%, considering it usury.Since then, various Courts of First Instance of different provinces (such as, Madrid, Oviedo, Cádiz and Murcia) have declared the nullity of the remunerative interest clause of various revolving cards.In some cases, the decision has been made when considering the abusive interest, while in others the issuing entities have been accused of their lack of transparency towards customers at the time of signing the contract.

On January 2, 2021, a new regulation of the Ministry of Economic Affairs and Digital Transformation entered into force, by virtue of which banks are obliged to offer clear pre -contractual information to customers about the Revolving Cards, and to verify their solvency beforeGive the green light to the application, among other issues.Failure to comply with penalties for banking.

What happened to the Wizink Plus card and the Wizink gold card?

Due to the controversy around the Revolving cards, Wizink responded at first by removing the Wizink gold card from its catalog and cutting the interest of the Wizink Plus card so that it will not exceed 20% on average that prevails in the market.

Subsequently, the entity chose to completely renew its commercial offer, which meant that the Wizink Plus card also disappeared.Today, the entity markets the Wizink Top card (for old customers), Wizink Now, Me and Click (for all audiences) and Wizink Wow (which will be available in 2022).

Cepsa Wizink Card: What is it for?

Another of the plastics issued by Wizink that is still being able to hire today (but that the entity does not advertise on its website) is the Cepsa Wizink card.This means of payment is a credit card with discounts on gasoline issued in collaboration with CEPSA that allows the holder to benefit from important fuel sales.

The Cepsa card, like other bank offers, is free and allows you to postpone purchases and payments in exchange for the holder to pay an interest of 18.36% TIN.As for its other advantages, it should be noted that:

Otros artículos que te pueden interesar:

- Todo sobre las comisiones de las tarjetas de crédito

- ¿Qué comisiones te cobran por usar tu tarjeta en el extranjero?

- Las mejores tarjetas para viajar